Want to Make Extra Money Now?

|

Need to access the MyCCPay Portal so that you can login, register your card, or learn what tools are available at www.myccpay.com?

If so, we’ll review the MyCCPay portal which is owned by Total Card, Inc. By logging into MyCCPay, you’ll have access to all your credit cards and be on top of your finances.

Who owns MyCCPay Payment Access?

According to Bloomberg, Total Card, Inc. (TCI) provides customized contact center support and financial products and services. Its contact center services include inbound, outbound, email and chat, customized interactive voice response, and literature fulfillment services. The company’s financial services comprise new account marketing, application processing, customer service, transaction services, security, risk and compliance, collections, payment processing, and portfolio management services for credit cards, consumer loans, private label credit, and recovery services. Total Card, Inc. was founded in 2000 and is based in Sioux Falls, South Dakota with an additional location in Luverne, Minnesota.

Which Credit Cards can access www.MyCCPay.com?

Total Card, Inc. who manages multiple credit cards allows you access your credit card through www.myccpay.com. Here are the following cards they manage:

- First Access Card

- Total Visa Card

- Emblem MasterCard

- Access MasterCard

- New Horizon MasterCard

First Access Card Login

The First Access Card is a true VISA® credit card that does not require perfect credit for approval. Complete an easy online application now and get a response in as little as 60 seconds!

Sign up: First Access Card Login

First Access Card Login: www.MyCCPay.com

Total Visa Card Login

The TOTAL Visa is a perfect tool for people who have faced financial challenges and struggled to get credit in the past. Complete a short application now and get a response from us online in seconds.

Sign up: Total Visa Card Login

Total Visa Card Login: www.MyCCPay.com

Other MyCCPay Credit Card Logins

There are three other cards that you can use MyCCPay.com to access:

- Emblem MasterCard

- Access MasterCard

- New Horizon MasterCard

Credit Card Access Login: www.MyCCPay.com

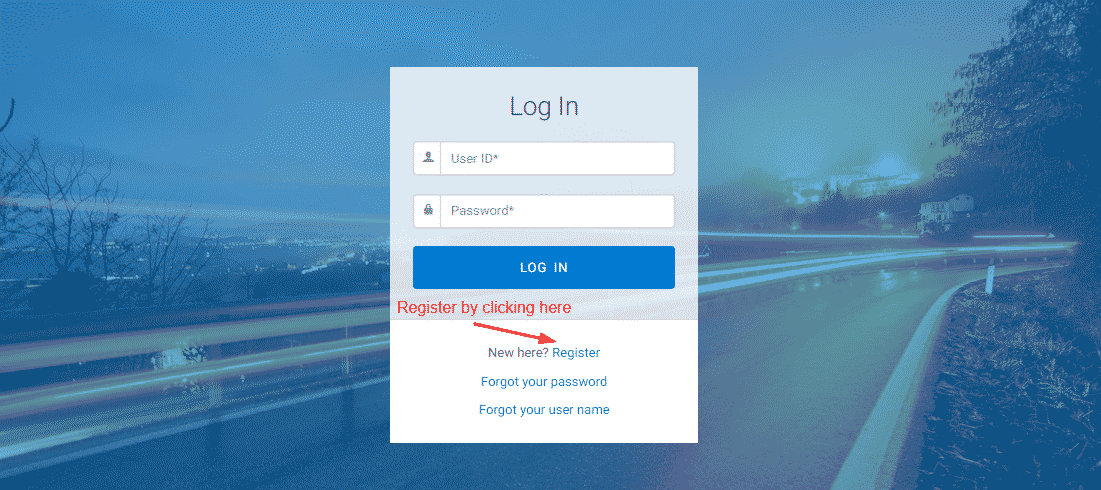

MyCCPay Register?

Once your application is approved for these cards,

- First Access Card

- Total Visa Card

- Emblem MasterCard

- Access MasterCard

- New Horizon MasterCard

Head to www.myccpay.com and click on ‘Register’ to sign up your credit card for online access.

And you’re credit card was received in the US Postal mail you’ll want to register your credit card on MyCCPay.com.

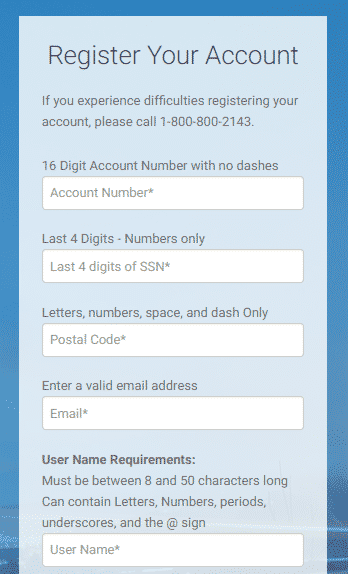

After hitting Register on the MyCCPay homepage, you’ll need to enter the following:

- Account Number (16 Digits with no dashes)

- Last 4 of SSN

- Post Code

- Valid email address

- Username

- Password

- Security Question

Register your account by completing all the required information.

Note: If you have your Total Visa card in your possession, please provide the following information for verification purposes and click the “Activate My Card” button on this page.

MyCCPay Login?

Once you’re account is completed, you can access your credit card online access at any time by visiting https://www.myccpay.com.

Your MyCCPay online access will let you view all your credit card transactions and billing statements.

How Can You Use ww.MyCCPay.Com & Make a Payment?

MyCCPay accepts Debit Card, Check by Phone, Money Gram, Western Union, and mail payments.

Please keep in mind all non-guaranteed funds payments, including personal checks and payments by phone, may have up to a fourteen-day processing hold in order to verify funds have cleared your bank.

You can service your account through www.myccpay.com. This will give you access to set up your account on an Automatic Payment Plan which is a convenient way to ensure that your monthly minimum payments post to your account by the due date each month. We also offer access to online statements, and you will be able to view account activity online.

Please refer to your Credit Card agreement for the full terms of your account.

Other Credit Cards You May Like

This list of top cash-back cards list will give you some insight if you’re getting ready to add a cash-back card to your wallet.

Today we’ll go over cash-back credit cards. Many of my friends know I’m a personal finance blogger and ask me about which credit cards have the best cash back programs or which offer the best rewards. Fortunately, many different credit cards offer reward systems and this makes the competition fierce and is better for consumers, i.e. you.

The top cash-back credit card list below is compiled of cards that offer the best bang for your buck. If you are going to sign up for a new credit card, make sure it is one that offers cash back for your purchases for starters. We want to get you the best maximum value for that plastic card you’ll use on a daily basis.

Best Cash-Back Credit Cards of 2019:

- Discover It: 1% cash back on everything, 5% cash back on rotating categories (this quarter is Uber/Lyft/etc).

- Chase Freedom: The categories are usually different than the ones for Discover, they work great together.

- Bank of America Cash Rewards: 1% cash back on every purchase, 2% at grocery stores and wholesale clubs and 3% on gas for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter. The advantage of a card like this is if you put a recurring payment like Netflix, Apple Music, etc on it and just auto-pay each month

- Citi Double Cash: 2% cash back on everything. This is my daily driver. 1% cash back when you spend + 1% cash back when you pay your bill.

If cash back is your goal, you’re going to generally want to stay away from cards with annual fees.

None of the ones I listed have an annual fee.

The Amex Blue Cash Everyday seems like a good card as well, you may want to look into that one to save more at the grocery store and gas stations, but it has as an annual fee as others in this thread have stated. Let’s dive deep in these cards.

1. Discover ItEarn 5% cash back at different places each quarter like gas stations, grocery stores, restaurants, Amazon.com and more, up to the quarterly maximum, each time you activate. Plus, earn unlimited 1% cash back on all other purchases — automatically. Welcome bonus: Enjoy a $50 statement credit. Click here to view the bonus. |

2. Chase FreedomEarn unlimited cash back Earn unlimited 1.5% cash back on every purchase – it’s automatic. No minimum to redeem for cash back.

Welcome bonus: $200 bonus after you spend $500 on purchases in the first 3 months from account opening. |

3. Bank of America Better Balance Rewards Card1% cash back on every purchase, 2% at grocery stores and wholesale clubs and 3% on gas for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter.

Welcome bonus: Online $200 cash rewards bonus after making at least $500 in purchases in the first 90 days of your account opening. |

4. Citi Double CashEarn cash back on your purchases with one of Citi’s best cash back credit cards. The Citi® Double Cash card lets you earn 2% cash back — 1% on purchases and an additional 1% as you pay for those purchases.

Welcome bonus: N/A |

Compare Credit Cards

Here is a review of the best cash-back credit cards with full details of Bonus rates, cash back rates, and annual Fee.

| Card | Bonus Rates | Flat Cash-Back Rate | Annual Fee |

| Capital One Savor Cash Rewards Credit Card | 4% on dining and entertainment and 2% at grocery stores | 1% | $95 (waived the first year) |

| Wells Fargo Propel Amex | 3x points on dining, travel and select streaming services and 1x on everything else; points are worth 1 cent apiece | 1% | $0 |

| Ink Business Cash Credit Card | 5% at office supply stores*; 2% on gas and restaurants** | 1% | $0 |

| Blue Cash Preferred Card from American Express | 6% cash back on purchases at US supermarkets (on up to $6,000 of spending each reward year, then 1%) plus 3% cash back at US gas stations, and 1% cash back everywhere else | 1% | $95 |

| Chase Freedom | 5% quarterly bonus on up to $1,500 | 1% | $0 |

| Chase Freedom Unlimited | 1.5% on all purchases | 1.5% | $0 |

| Capital One Quicksilver Card | 1.5% on all purchases | 1.5% | $0 |

| Citi Double Cash Card | 1% when you make purchases, 1% when you pay your bill | 1% | $0 |

| Discover it® Cash Back | With the Discover it card, you can earn 5% cash back on up to $1,500 in purchases made in accordance with Discover’s 2018 Cashback Calendar after enrollment.; Discover will match cash-back for first year. | 1% | $0 |

| Bank of America Cash Rewards credit card | 2% back at grocery stores and wholesale clubs and 3% on gas for the first $2,500 in combined grocery/wholesale/gas purchases each quarter | 1% | $0 |

Best Cash Back Cards Summary

Hopefully, this list has given you some insight if you’re getting ready to add a cash-back card to your wallet.

To summarize:

- Discover It: 1% cash back on everything, 5% cash back on rotating categories (this quarter is Uber/Lyft/etc).

- Chase Freedom: The categories are usually different than the ones for Discover, they work great together.

- Bank of America Cash Rewards: 1% cash back on every purchase, 2% at grocery stores and wholesale clubs and 3% on gas for the first $2,500 in combined grocery/wholesale club/gas purchases each quarter. The advantage of a card like this is if you put a recurring payment like Netflix, Apple Music, etc on it and just auto-pay each month

- Citi Double Cash: 2% cash back on everything. This is my daily driver. 1% cash back when you spend + 1% cash back when you pay your bill.

Could you use a free $10 on us?Join Swagbucks for free. Swagbucks pays you to watch videos, search, shop, take surveys, and more. They have paid out so much free money so far! Join Now and Get $10 Free |

No Comments

Leave Comment